Today we are going to discuss RattanIndia Enterprises share price target 2025, we will discuss how it faired in 2023 and what will happen in 2024, 2025, 2026, 2027, 2030, and 2035. RattanIndia Enterprises is listed in NSE as RTNINDIA and in BSE as 534597. The stock of this company has been in the limelight since its inception in NSE in 2021 when its share price spiked up suddenly and this stock became a multi-bagger, we will try to learn why it spiked this way and try to analyze its future growth, will it grow even further or the happy run will come to an end. Let’s start with our prediction of the RattanIndia first.

Table of Contents

RattanIndia Enterprises Share Price Target 2024, 2025, 2026, 2027, 2028, 2029, 2030 and 2035

| Year | 1st Price Target | 2nd Price Target |

|---|---|---|

| 2024 | 90 | 100 |

| 2025 | 105 | 128 |

| 2026 | 125 | 150 |

| 2027 | 144 | 172 |

| 2028 | 168 | 188 |

| 2029 | 190 | 200 |

| 2030 | 210 | 230 |

| 2035 | 280 | 350 |

About RattanIndia Enterprises

RattanIndia Enterprises Ltd is the flagship of RattanIndia Group, this company majorly deals in the latest technologies focusing on new-age businesses which include but are not limited to e-commerce, electric vehicles, fintech, and drones. They have various subsidiaries company through which they operate, they handle the e-commerce business through Cocoblu Retail Ltd. Revolt Motors is in the electric bike segment, and they cover the fashion industry through Neobrands, whereas Neosky deals in Drones as a service and product. Wefin is their fintech wing that deals in the digital lending marketplace in partnership with banks. RattanIndia Enterprises Ltd was founded by Mr. Rajiv Rattan who is cofounder of Indiabulls Group. Its chairperson is Mrs. Anjali Rattan Nashie.

Fundamental Analysis of RattanIndia Enterprises

Company Key Metrics

| Parameters | Value |

|---|---|

| MARKET CAP | ₹ 10,788.61 Cr. |

| P/E Ratio | 73.07 |

| P/B Ratio | 14.78 |

| FACE VALUE | ₹ 2 |

| DIV. YIELD | 0 % |

| 52 Weeks High | ₹ 86 |

| 52 Weeks Low | ₹ 32.15 |

| PROMOTER HOLDING | 74.86 % |

| EPS (TTM) | ₹ 1.07 |

| ROE | -51.62 % |

| ROCE | -20.70% |

| PROFIT GROWTH | -151.66 % |

| Debt to Equity | 1.74 |

Last 5 Year’s Consolidated Revenue and Profit (In Crores)

| Year | Revenue | Profit |

|---|---|---|

| 2019 | .49 | -1308 |

| 2020 | 1.57 | -153 |

| 2021 | 1.82 | 0.01 |

| 2022 | 593 | 554 |

| 2023 | 4138 | -286 |

Findings from the tables

- RattanIndia Enterprises is a small-cap company.

- The PE Ratio is very high, which shows that the stock is overvalued.

- PB ratio is also very high.

- RattanIndia Enterprises touched an all-time high in 2023.

- Promotor holding is 74.86%, which is a good sign.

- RattanIndia Enterprises has a lot of debt.

- The growth trajectory has been inconsistent, and last year has seen a negative of more than 150%.

- The company’s revenue is increasing but they are not making any profit yet, not an ideal condition for a company.

Industry Analysis

RattanIndia Enterprises is in the cutting-edge technology business, which is the future of the world. The industry will grow at a tremendous rate in the future, Electric bikes and drones are already booming at present which will only grow in the future. So RattanIndia Enterprises may become a very successful company soon. This is the reason so many people are investing in this company.

Also Read: Mazagon Dock share price target 2025 to 2035

Peer Comparision

As I said before this industry is a growing industry and some of the peer companies already doing good business and generating good profits. If we compare RattanIndian Enterprises with its peers then we might feel it is lagging in terms of almost everything. Some of its Peer companies are:

- SIS Ltd

- TeamLease Services Ltd.

- Aarvi Encon Ltd.

- NBCC (India) Ltd.

Company Growth Prospect

- RattanIndia Enterprises is in a growing industry so it is expected that this company will grow in the future.

- The E-commerce market will only increase in the future which is a good sign.

- Revolt Motors planning to introduce an e-bike in the worldwide market, which again is a good sign.

- Drone logistics are booming and the company is investing in this which may be fruitful for the company.

- The overall growth prospect of RattanIndia Enterprises in the future is very good, they are likely to become successful in the near future.

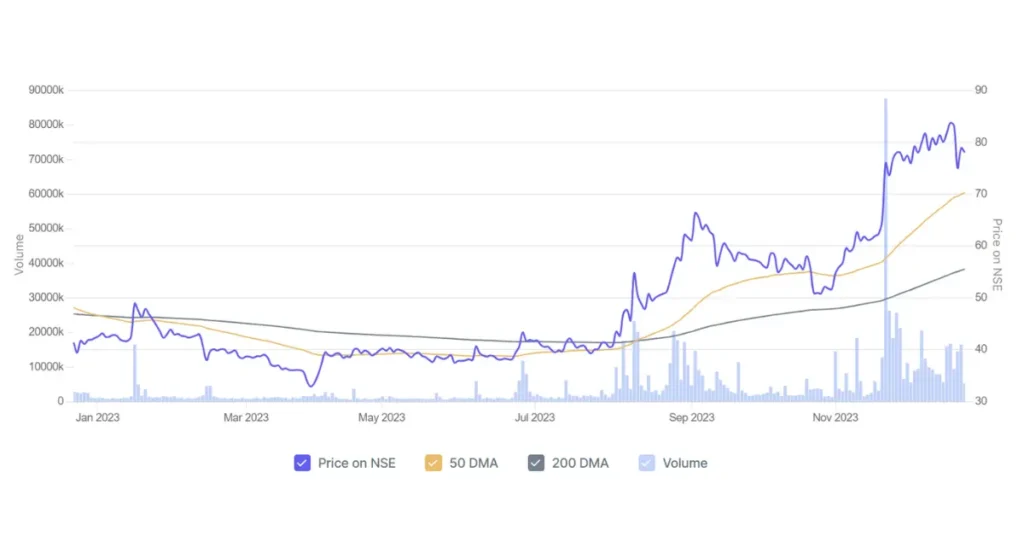

200 Days Moving Average

This image clearly shows that RattanIndia Enterprises is an overvalued stock for now, if you want to invest in this company based on future aspects then you can take a risk but as per the 200 DMA of this company, it is already trading as an overvalued stock but it is not an overbought stock.

Is RattanIndia Enterprises a good buy?

As per the above analysis, RattanIndia Enterprises already trading way beyond its book value. It has a good future but as of now company is not performing well and its share is rising in the hope of future returns. It has become a multi-bagger in the past and it has the potential to be a multi-bagger in the future as well but you will be taking a risk. If you are ready to take that risk then you can invest in this company. Some of the pros and cons of the company are:

Pros

- Promotor holding is 74.86 %.

- Deals in growing industry.

- Know the use of its assets very well.

- Top performing stock.

Cons

- The company is in huge debt.

- Profit generation is not consistent.

- Overvalued stock.

- ROE and ROCE are negative.

- Doesn’t give a Dividend.

RattanIndia Enterprises Share Price Target 2024

RattanIndia has touched an all-time high in 2023 so it may revolve around the same next year also, it may trade between 90 to 100 in 2024.

RattanIndia Enterprises Share Price Target 2025

If the company starts generating profit then investors may show more trust in the company and as future of the company is already bright, it just has to begin generating profits. RattanIndia Enterprises may trade between 105 to 128 in 2025.

RattanIndia Enterprises Share Price Target 2026

By 2026, e-bikes and drones will be more common than ever and this company may benefit from this opportunity and may perform well by then. If we consider this analysis then RattanIndia Enterprises may trade between 125 to 150 in 2026.

RattanIndia Enterprises Share Price Target 2030

If you are planning to invest for the long term then this company should be on your watchlist as it may very well become a multi-bagger in the future. If everything goes according to the company’s plan then it will touch the sky and RattanIndia Enterprises Share Price Target 2030 is likely to be in the range of 210 to 230.

RattanIndia Enterprises Share Price Target 2035

This company has the potential to grow exponentially and by 2035 it become a huge success but that could depend on various factors. If you are a risk taker and want to invest in this company for a very long term, then as per our analysis RattanIndia Enterprises may trade between 280 to 350 in 2030.

It may very well go beyond that but we assume that it will be around this number.

Conclusion

As per our analysis, RattanIndia Enterprises has the potential but numbers are not backing their potential. It has given below-average performance in the past few years but its stocks are rising in the hope of future growth. The financials of the company are not good and it may collapse in adverse conditions. It is an overvalued stock that may continue to rise as its business model is good.

Disclaimer: Information provided in this article is my personal opinion and it is for general informational purposes only and should not be considered as financial advice. Investing involves risks, and individuals should conduct their own research or consult with a qualified financial professional before making any investment decisions. Past performance is not indicative of future results, and the content provided is subject to change without notice. We do not guarantee the accuracy or completeness of the information and disclaim any liability for financial decisions made based on this content.

FAQs

Is RattanIndia Enterprises a good buy?

It is an overvalued stock, but the future of the company is bright.

Is Rattan India owned by Tata?

It is founded by the cofounder of Indiabulls Mr. Rajiv Rattan, it has no relation to Tata.

What does RattanIndia Enterprises do?

Focus on businesses with the latest technologies including fintech, e-bikes, and drones.

When did RattanIndia Enterprises start?

RattanIndia Enterprises was started in 2010 by Mr. Rajiv Rattan.

What is the dividend of RattanIndia Enterprises?

RattanIndia Enterprises has not given dividends to its shareholders till now.

Also read: Kritika Wires Share Price Target